For many people, 2021 was the year to buy a home. Whether it was first-time home buyers, or people finally finding their dream homes, chances are someone you know was involved in buying or selling a home.

But with the new year comes a new housing market, and we were curious as to what the new year will bring for homeowners and homebuyers. We surveyed over 1,100 Americans across the country to better understand their views on what this year may look like from a homeowner's or home buyer’s perspective.

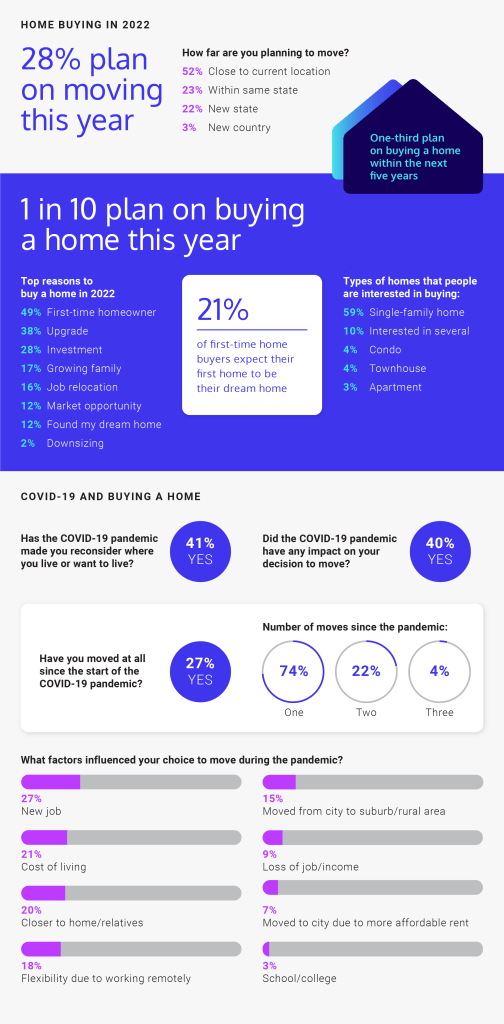

According to respondents, about 3 in 5 people are planning to move this year! For over half of those moving, they plan to stay pretty close to their current location. But about a quarter (22%) are planning on moving to a new state, and even some (3%) are planning an international move.

Since a lot of people are reportedly planning a move in 2022, we were curious as to how many of those moves include buying a home. 1 in 10 say this is the year that they plan on buying a home, including first-time homeowners. Other reasons people are planning to buy a home this year include job relocation, a growing family, upgrading, or downsizing.

1 in 5 respondents are expecting their first home to be their dream home, and for most people, they’re looking for that dream single-family home.

The COVID-19 pandemic has had a huge influence on all of our lives, and that includes the housing market. 41% of respondents say the pandemic has made them reconsider where they live or where they want to live, and over one-quarter (27%) have already moved at least once since the start of the pandemic!

Why might people have moved in the last couple of years during a global pandemic? People said that remote work allowed them to live where they wanted, they got a new job, they wanted to move closer to relatives, or they wanted to move out of the city and into the suburbs.

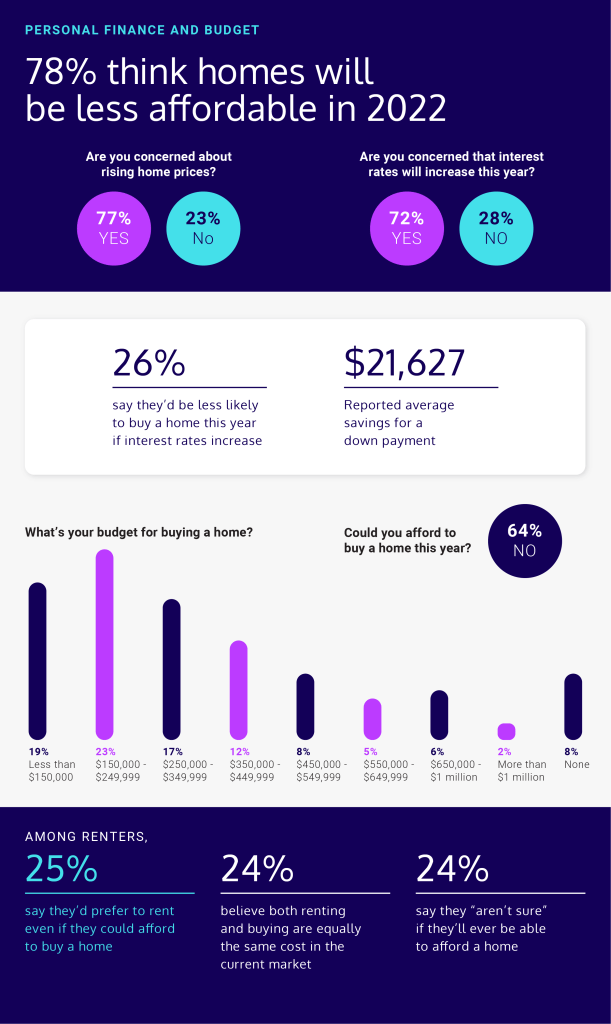

As more people look toward buying a new home, or even their first home, rising market costs are a concern. In fact, nearly 4 in 5 people think that homes will be less affordable in 2022. 4 in 5 are also concerned about rising home prices, and 72% say they’re concerned about an increase in interest rates. If interest rates do continue to rise, 26% add that they’ll be less likely to buy a home this year because of those rates.

When asked about budgets, the majority of respondents say they’re looking at homes in the range of $150,000 to $249,999. And when it comes to a down payment, the average amount of savings that people have is about $52,500. Can people even afford to buy a home this year? According to 64% of respondents, that answer is no.

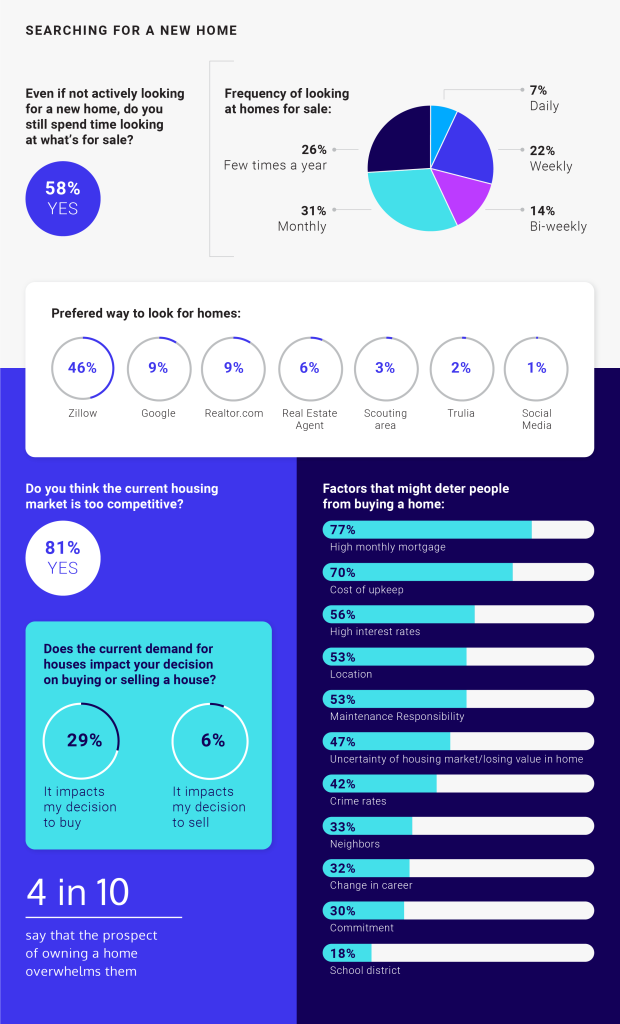

Before you even buy a house and consider moving, you have to actually find somewhere you want to live. Back in the day, you could drive around neighborhoods where you wanted to live and see if there were any “For Sale” signs popping up. Now, thanks to the internet and social media, looking at homes for sale has become a pastime!

More than half (58%) of our respondents say they still spend time looking at what’s for sale, even if they’re not actively searching for a new home. For some, this is a daily activity while for others it’s monthly. It may come as no surprise, but Zillow is the most popular way people look at homes for sale, as the platform allows for easy scrolling through what’s available.

But even if they find their dream home, there’s no guarantee it’ll still be available by the time they can put in an offer. 4 in 5 believe the current housing market is too competitive and that the current demand for houses would impact their decision to buy.

Owning a house, especially for the first time, may also be overwhelming. 4 in 10 say that even the prospect of owning a home overwhelms them. Some of the most potential overwhelming factors include a high monthly mortgage, the cost of upkeep, the home’s location, and rising crime rates.

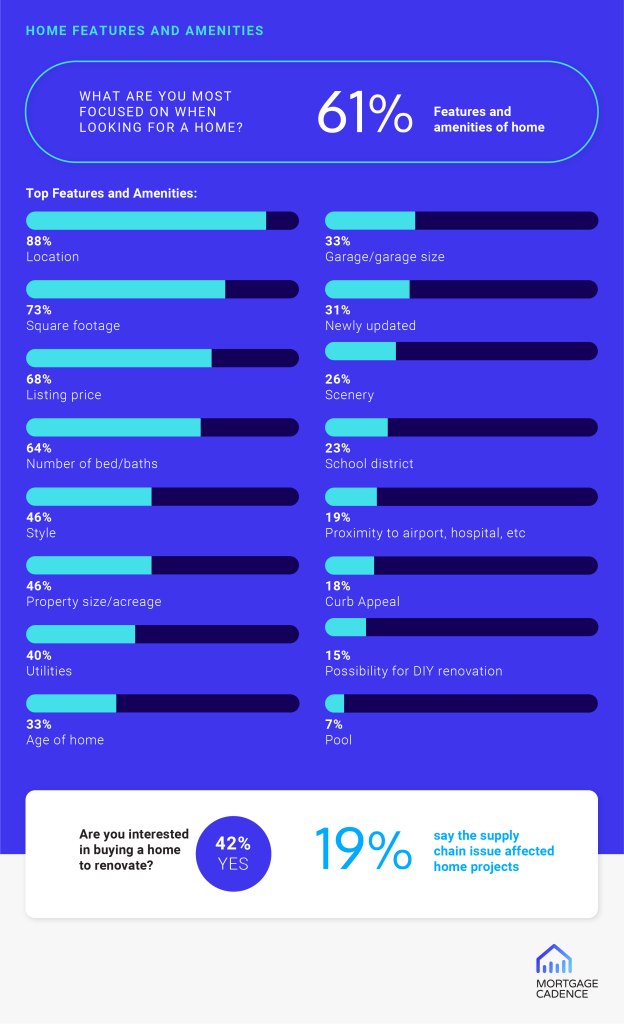

When it comes to looking and finding a home, we all have different priorities. Some people (39%) say it’s more important how they feel about the home, while the majority (61%) say it’s all about the home's features.

The most important feature, according to respondents, is the property location (88%). Other important features include the size of the home (73%), its price (68%), its number of beds/baths (64%), and the year it was built (33%). 15% also reported a home’s DIY potential as one of the most important factors when looking for a home. Some people may be interested in flipping a house and truly making it what they want to be!

In fact, more than 4 in 10 say they’re interested in buying a home and then doing home renovations, either DIY or for hire. Unfortunately, 19% say that the recent supply chain issue is affecting those home projects.

Methodology

In January 2022, we surveyed 1,105 Americans to get their feedback on homeownership and what this year will bring in terms of a homeowner's outlook. Respondents were 48% female and 49% male, with an age range of 18 to 79 and an average age of 37 years old.

For media inquiries, contact media@digitalthirdcoast.net.

Fair Use

When using this data and research, please attribute by linking to this study and citing http://www.mortgagecadence.com.